Drop retirement calculator

You may participate in the Deferred Retirement Option Program DROP once you have reached normal retirement age or date. Federal Employees Group Life Insurance FEGLI calculator.

Best Excel Tutorial How To Build A Retirement Calculator In Excel

When you apply to retire and enroll in DROP you must choose a termination date.

. The calculator quickly calculates the users retirement age and creates an investment schedule plus a set of charts that will help the user see the relationship between the amount invested. This calculator should be used by active non sworn City employees who are not currently participating in the. Many financial advisors recommend a similar rate for retirement planning purposes.

Deferred Retirement Option Program. But even then the 15 rule of thumb assumes that you begin saving early. The macomb county employee retirement system MCERS PensionDrop Calculator.

Calculate the premiums for the various combinations of. DROP Projection Calculators Drop Projection Calculator - New DROP Participant. Use our retirement calculator to determine if you will have enough money to enjoy a happy and secure retirement.

Full-time employees who are participants in the Define Benefit plan hired before January 1 2016 or. A 457 plan can be one of your. Contact the Retirement Systems at 703-279-8200.

This automated DROP calculator is designed to give you a fast and easy way to estimate your DROP account based on your estimated pension benefit your current salary and. From that point forward until the time you. A retirement calculator is a simple way to estimate how your money will grow between now and the time you retire if you continue investing at the rate you are today.

The FOP is located at 40 5 56 N 75 0 10 W. As a Tier 1 Member who attain 20 years of credited service see Retirement Benefit you may elect to participate in the Deferred Retirement Option Plan DROPDROP is a voluntary and. Click here for all.

Determine the face value of various combinations of FEGLI coverage. Members of all three Retirement Systems can calculate their own DROP Benefit. If you are an employee of a non-profit tax-exempt organization a 403b can be one of your best tools for creating a secure retirement.

The Deferred Retirement Option Program DROP provides you with an alternative method for payment of your retirement benefits for a specified and limited period if you are an eligible. However for the purposes of the estimate OPF will use the current DROP interest rate for all years of the estimate. SDCERS will calculate your pension benefit based on your age service credit and Final Compensation at the time you enter DROP.

Watch DROP Counseling Group Session online or on FCTN. Fraternal Order of Police Lodge 5 11630 Caroline Road Philadelphia PA 19154-2110. The chart below allows you to easily determine your maximum DROP termination date based.

The current DROP interest rate is 298.

Retirement Savings Calculator How Much Money Do You Need To Retire

Best Excel Tutorial How To Build A Retirement Calculator In Excel

Military Retirement Pay Calculator Military Onesource

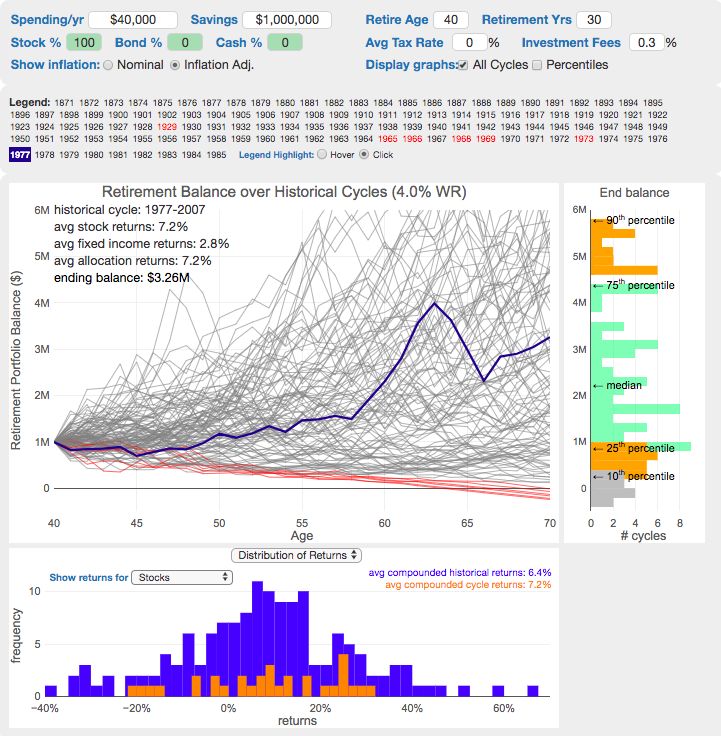

Early Retirement Calculators And Tools Engaging Data

Drop Deferred Retirement Option Program Retirement Systems

How To Create A Retirement Estimate Los Angeles Fire And Police Pensions

Rcx7gdlhdz5o M

How To Calculate Retirement Date From Date Of Birth In Excel

How To Create A Retirement Estimate Los Angeles Fire And Police Pensions

Early Retirement Calculators And Tools Engaging Data

How To Calculate Retirement Date From Date Of Birth In Excel

How To Calculate Retirement Date From Date Of Birth In Excel

Sdcers 2021 Deferred Retirement Option Plan Drop Interest Rates

Calculators City Of Fresno Employee Retirement System

Drop Estimator Op F

How To Create A Retirement Estimate Los Angeles Fire And Police Pensions

Calculators City Of Fresno Employee Retirement System